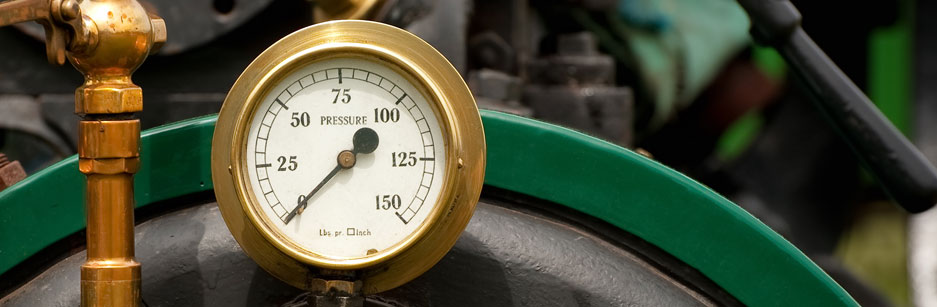

Boiler & Machinery coverage– also known as equipment breakdown insurance — fills in the gaps in standard commercial property policies. Boiler & Machinery coverage provides protection against the mechanical breakdown of boilers, heating/refrigeration systems, mechanical equipment and computers & communication equipment. Any businesses with machinery and equipment exposures need boiler & machinery coverage including light manufacturers, pharmaceutical companies, heavy manufacturing companies, chemical companies and utilities.

What is covered under Boiler & Machinery coverage:

- Property Damage

- Off-Premises property damage

- Business income

- Contingent business income

- Extra expense

- Service interruption

- Perishable goods

- Demolition

- Ordinance or law

- Expediting expenses

- Hazardous substances

- Data restoration

- Newly acquired locations

- Errors and omissions

- Brand and labels

- Waive of in-use restriction

With the advances in technology, the chance of an equipment breakdown is greater today compared to years past. To protect you business from potential risks, Boiler & Machinery coverage should be a part of your business insurance package. Contact us today to learn more about Boiler & Machinery Coverage and commercial insurance options for your business.